Securely, profitably, at scale.

We simplify the process for institutional funders, pension managers, mutual funds, and high-net-worth individuals who want to participate in one of West Africa’s most vibrant financial markets—without the difficulty of building the infrastructure themselves.

We carefully structure and manage our digital lending portfolio to keep portfolio-at-risk (PAR) within safe regulatory limits, ensuring a balance between growth and asset quality.

Thanks to our partnerships with Ghana’s leading Mobile Money platform, you can tap into millions of active users right from the start, allowing for large-scale capital deployment from day one.

Through our collaboration with top fintech providers, we harness advanced credit scoring, data analytics, and automated workflows, enabling us to deliver fast, cost-effective lending solutions.

We’re licensed by the Bank of Ghana, which means we operate under strict governance and compliance standards. This transparency helps reduce operational and regulatory risks for our partners.

We extend credit to micro and small businesses, helping them grow, create jobs, and strengthen their communities. By supporting Ghana’s MSME sector, which makes up 90% of the economy, your capital not only grows but also contributes to meaningful economic transformation. Your capital doesn’t just grow, it transforms.

With MSMEs comprising over 90% of Ghana’s businesses, there’s a significant financing gap that needs to be filled.

Mobile money usage is over 85%, offering a cost-effective and far-reaching way to deliver services.

The evolving regulatory framework for digital lending is creating advantages for early movers who have strong compliance in place.

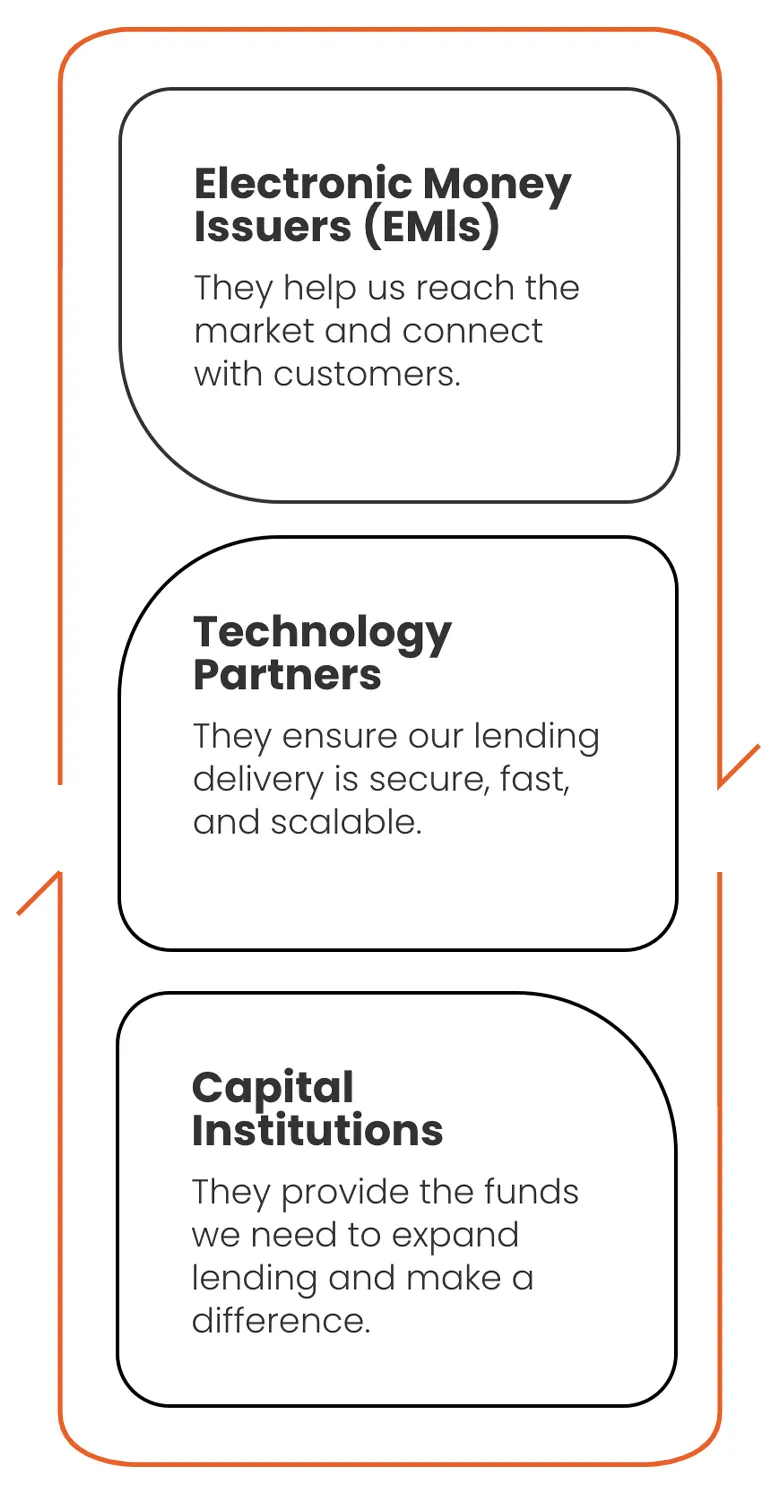

They help us reach the market and connect with customers.

They ensure our lending delivery is secure, fast, and scalable.

They provide the funds we need to expand lending and make a difference.

Chairman & Investor

A successful investor and entrepreneur who has spearheaded multiple businesses in Africa and Europe over his 30-year career. His expertise lies in business & people management, technology and financial services.

Managing Director (Designate)

A fintech professional specialising in digital lending and financial inclusion. With almost a decade of experience in mobile financial services and MSME finance…

Executive Director

Seth Mario Annan has over fifteen years of experience in the financial markets, previously working as a Relationship Manager at HFC Bank, now Republic Bank.

Manage Consent: To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Chairman & Investor, Peter Gbedemah is a successful investor and entrepreneur who has spearheaded multiple businesses in Africa and Europe over his 30-year career. His expertise lies in business & people management, technology and financial services.

For Peter, it has always been about more than just commercial success. Throughout his career, he has been committed to giving back, particularly in Africa. His goal is to extend MHT’s reach and services, ultimately contributing to the financial ecosystem and broader economic growth in Ghana.

Managing Director (Designate), Gloryjoy Nti-Obeng is a fintech professional specialising in digital lending and financial inclusion. With almost a decade of experience in mobile financial services and MSME finance, she helped launch Ghana’s first nano-credit digital products and has played a key role in designing and scaling inclusive financial solutions that reach millions. She is dedicated to developing financial products for underserved communities, particularly women entrepreneurs.

Seth Mario Annan has over fifteen years of experience in the financial markets, previously working as a Relationship Manager at HFC Bank, now Republic Bank. He holds a bachelor’s degree from the University of Ghana, Legon, and an MBA in Marketing. Recently called to the Ghana Bar, he offers legal advice on corporate governance, policy formulation, litigation, and mergers and acquisitions. He brings strong regulatory and compliance acumen and holds influence within the industry through his longstanding contributions to responsible finance and institutional governance.

Thank you for contacting us,

we’ll be in touch very soon.